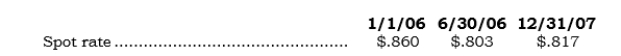

On 1/1/06, Forcax purchased an at-the-money foreign currency put option from an FX trader involving 1,000,000 euros at a cost of $14,000. The option expires on 12/31/06 and is exercisable at $.85. The option was (a) obtained to hedge Forcax's budgeted 2006 export sales to Germany and (b) exercised on 12/31/06. For simplicity, assume that the only interim reporting date was 6/30/06, when the option's fair value was $54,000. Actual export sales to Germany for the first six months of 2006 were 400,000 euros. Direct exchange rates for the euro are as follows:

Required:

Required:

Prepare all journal entries relating to the FX option.

Correct Answer:

Verified

Q246: _ On 1/1/06, Putax purchased a 1-year

Q247: _ Use the information in the preceding

Q248: _ On 1/1/06, Callex purchased a 1-year

Q249: _ On 1/1/06, Optux purchased a 1-year

Q250: On 11/16/06, Expox entered into a 60-day

Q251: On 11/1/06, Impox entered into a 90-day

Q252: On 12/1/06, Salox entered into a 50-day

Q253: On 11/1/06, Purox entered into a 90-day

Q254: On 8/3/06, Salorc obtained a noncancelable sales

Q255: On 12/1/06, Purorc ordered machinery (under a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents