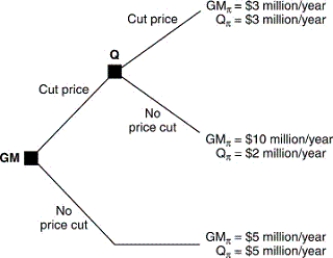

Consider the following decision tree.This tree illustrates hypothetical payoffs to General Mills (GM) and Quaker Oats (Q) if they engage in a price war.

If GM cuts prices,the greatest potential gain is:

A) $5 million per year.

B) $10 million per year.

C) $2 million per year.

D) $3 million per year.

E) none of the above.

Correct Answer:

Verified

Q2: The difference between game trees and decision

Q3: Which pair of strategies would competing firms

Q4: If player 1 has a dominant strategy,then

Q5: By definition,a Nash equilibrium in a duopoly

Q6: Potential entrant E threatens to enter incumbent

Q7: Game theory is useful for understanding oligopoly

Q8: A Nash equilibrium occurs when:

A) each player

Q9: A dominant strategy is one that:

A) beats

Q10: In a two-player game in which each

Q11: Getting to a Nash equilibrium requires:

A) each

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents