Whitt Valley Presbyterian Hospital is a nonprofit initial care facility. For the hospital's calendar year ending December 31, 2019, prepare (I) journal entries to record the transactions listed in a. through n. below, (II) a trial balance based on your entries and the beginning balances listed at o. below, and (III) a Statement of Operations and a Statement of Changes in Net Assets for the hospital.

a. Third-parties payers and direct-pay patients were billed $6,500,000 at the hospital's established billing rates

b. The hospital determined that certain of its patients qualified for charity care and that it would not seek to collect $950,000 at established billing rates from direct-pay patients

c. The hospital estimated contractual adjustments for the year of $1,600,000

d. The hospital originally estimated uncollectible amounts from direct-pay patients to be $250,000 (recall that original estimated uncollectible amounts reduce revenue; only estimates specific to an individual patient are reported as bad debt expense).

e. The hospital received capitation premiums of $2,500,000. It estimated that the cost of providing this care was $1,800,000

f. The hospital received payments from third-party payers and direct-pay patients totaling $3,500,000

g. The hospital received contributions of $1,100,000 that were restricted by donors for building a new urgent care wing

h. The hospital paid salaries and wages of $4,500,000 in cash; these amounts are reported as patient care expense

i. The fair value of investments required to be held in perpetuity increased by $25,000

j. The hospital received cash from interest and dividend income of $10,000 on investments without donor restrictions

k. The hospital used $1,375,000 of net assets with donor restrictions to construct a new urgent care wing, consistent with the restrictions created by the donors

l. The hospital reported depreciation expense of $475,000

m. The hospital used drug inventories of $365,000

n. The hospital incurred other operating costs for patient care of $275,000 on credit

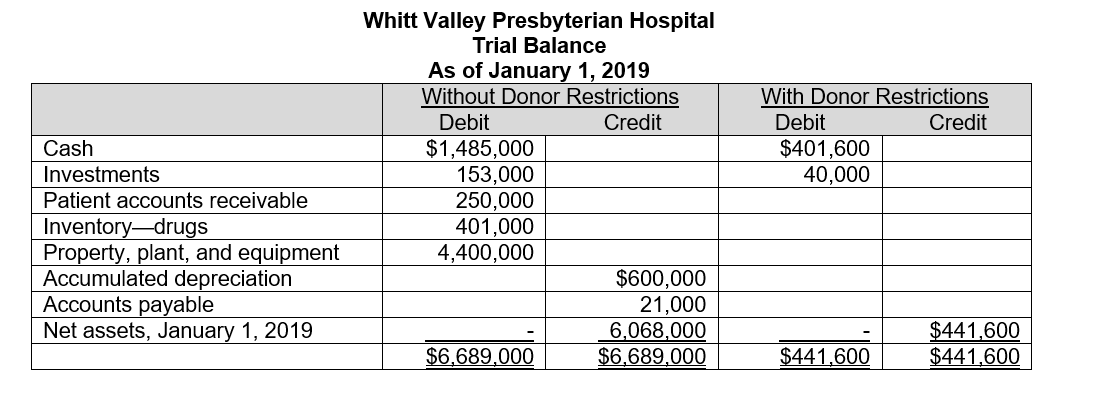

o. The hospital's beginning of the year trial balance at January 1, 2019 was as follows:

Correct Answer:

Verified

Q36: A nonprofit hospital purchased an equity security

Q37: Catlett County Hospital, a governmental hospital, has

Q38: A group of fine dining restaurants in

Q39: A nonprofit hospital, the Ruth Clark Hospital

Q40: A nonprofit hospital's trustees designate $600,000 of

Q41: Under what circumstances do nonprofit hospitals sometimes

Q42: A governmental hospital has about 30 outstanding

Q43: What categories of net assets are required

Q44: Prepare journal entries to account for the

Q45: Lucas Community Hospital is a nonprofit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents