Shumer Inc. is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $350,000 per year for the next 5 years. The equipment needed will cost $2,500,000. In order to purchase this equipment, Shumer must acquire the necessary funds from several sources.

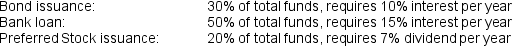

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Does the proposed project's rate of return exceed the company's weighted average cost of capital?

Correct Answer:

Verified

Bonds:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Sammy Corporation is considering two alternative investment

Q66: Sammy Corporation is considering two alternative investment

Q67: Pink Petunias, a wholesale nursery, is considering

Q68: Pink Petunias, a wholesale nursery, is considering

Q69: In a financial spreadsheet calculation, "Nper" stands

Q71: Shumer Inc. is a construction company that

Q72: TG Enterprises owns a small start-up company,

Q73: TG Enterprises owns a small start-up company,

Q74: IBBC Co. has additional funds that need

Q75: Harrison Co. has additional funds that need

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents