Shumer Inc. is a construction company that plans on purchasing new equipment this year for a new project. The project is expected to return $3500,000 per year for the next 5 years. The equipment needed will cost $2,500,000. In order to purchase this equipment, Shumer must acquire the necessary funds from several sources.

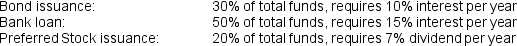

The following list shows the proportion of funds expected from each source, and the rate of interest (or similar cost) that will be required for each source:

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Shumer is a very conservative company, and requires a "buffer margin" of 5 percentage points for any large investment project.

Does the proposed project meet the company's required rate of return?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Sammy Corporation is considering two alternative investment

Q67: Pink Petunias, a wholesale nursery, is considering

Q68: Pink Petunias, a wholesale nursery, is considering

Q69: In a financial spreadsheet calculation, "Nper" stands

Q70: Shumer Inc. is a construction company that

Q72: TG Enterprises owns a small start-up company,

Q73: TG Enterprises owns a small start-up company,

Q74: IBBC Co. has additional funds that need

Q75: Harrison Co. has additional funds that need

Q76: Scription Inc. has additional cash available for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents