Seligman, Inc. has a computer that originally cost $15,400. Depreciation has been recorded for five years using the straight-line method, with a $1,400 estimated salvage value at the end of an expected seven-year life. After recording depreciation at the end of the fifth year, Seligman disposes of the computer.

Required:

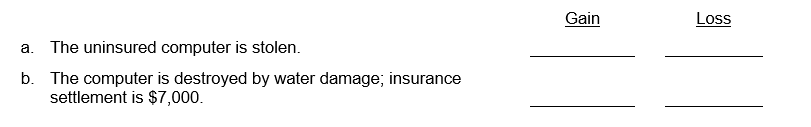

For each of the following independent disposals of the computer, place the dollar amount of the recognized gain or loss in the appropriate column. If there is no recognized gain or loss, place a zero in each column.

Correct Answer:

Verified

($15,400 - $1,400) / 7 = $2,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: On July 1, Boise Systems Company purchased

Q125: For each of the following items, indicate

Q126: Place an X in the appropriate column

Q127: Watson Packaging sold a machine for $16,500.

Q128: Schuler Company had machinery that had originally

Q129: Following is a numbered list of assets

Q130: Determine the 2019 asset turnover for Star

Q131: The following information is reported for the

Q132: Weld It Company has a machine that

Q133: Blanket Company has a machine that originally

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents