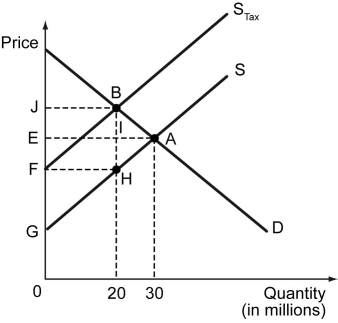

The figure below shows the demand (D) and supply (S) curves for Good X before and after a tax is imposed on each unit of the good sold.

-Refer to the figure above.If the pre-tax equilibrium price of Good X was $3 and the price that consumers need to pay after the imposition of a per-unit tax of $3 is $5,the tax incidence on consumers is approximately ________.

A) 50 percent

B) 2 percent

C) 3 percent

D) 67 percent

Correct Answer:

Verified

Q115: The figure below shows the demand (D)

Q116: The figure below shows the demand (D)

Q117: When does the burden of a tax

Q118: The demand curve for pizza in Perilia

Q119: The figure below shows the demand and

Q121: The burden of a tax falls more

Q122: Which of the following is true?

A) A

Q123: Why are lump-sum taxes regressive in nature?

Q124: The following figure depicts the market for

Q125: A lump-sum tax is a(n)_.

A) progressive tax

B)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents