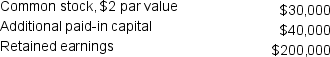

Paul Merema, a disciplined investor, prefers the stock of a company with a higher ratio of retained earnings against contributed capital, preferably above 2 in his opinion. He finds LMN Company acceptable because the equity breakdown at June 30, its year end, is as follows:

On July 1, the day after its year end, LMN announced it will declare a 22% stock dividend. The stock price on this date is $20 per share.

On July 1, the day after its year end, LMN announced it will declare a 22% stock dividend. The stock price on this date is $20 per share.

With which accounting treatment will Paul be more pleased-a large or a small stock dividend?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Colossal Combines has 20,000 shares of convertible

Q45: Amusement Corporation reports the following components of

Q46: Stay Fit Company has $1,600 of convertible

Q47: Sea Star Company has preferred stock with

Q48: Following is the stockholders' equity section of

Q50: The stockholders' equity section of the Music,

Q51: Following are selected stock transactions and information

Q52: Vast Horizons has 20,000 outstanding shares of

Q53: Many companies buy back their outstanding stock

Q54: Identify the benefits received from being a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents