Vast Horizons has 20,000 outstanding shares of common stock with par value of $1.50 per share and market price on January 1 of $30.

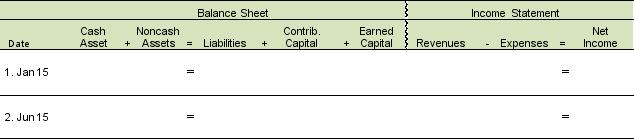

A. Show the financial statement effects of the two independent equity transactions in the template below.

1. January 15: 6% stock dividend paid to common shareholders with current market price at $30

2. June 15: 28% stock dividend paid to common shareholders with current market price at $80

B. How have these two transactions changed the overall valuation of the firm?

B. How have these two transactions changed the overall valuation of the firm?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Amusement Corporation reports the following components of

Q46: Stay Fit Company has $1,600 of convertible

Q47: Sea Star Company has preferred stock with

Q48: Following is the stockholders' equity section of

Q49: Paul Merema, a disciplined investor, prefers the

Q50: The stockholders' equity section of the Music,

Q51: Following are selected stock transactions and information

Q53: Many companies buy back their outstanding stock

Q54: Identify the benefits received from being a

Q55: Describe the benefits for an individual investor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents