Pacific Northwest Sporting Goods reported annual depreciation on a newly acquired asset for 2016 in the amount of $80,000 using the straight-line method. For tax purposes, the company used the following schedule of depreciation expense:

Year 1: $144,000

Year 2: $116,000

Year 3: $ 92,000

Year 4: $ 84,000

Year 5: $ 64,000

Year 6: $ 56,000

Year 7: $ 48,000

Year 8: $ 36,000

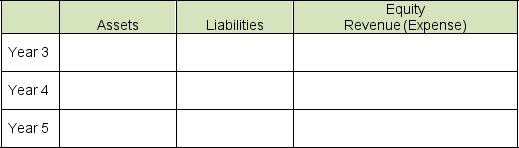

Annual income before depreciation expense for each year is steady at $440,000 and the income tax rate is 35%. Show the financial statement effects relating to taxes in years 3 to 5 assuming taxes are paid at the same time they are accrued using the following template:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Which one of the following statements is

Q32: Festival Corp. disclosed the following footnote in

Q33: Complete Foods Markets reports lease information in

Q34: La Grange Supply Company disclosed the following

Q35: Monongahela Corporation includes the following in its

Q37: Sweets Corp. reported the following items in

Q38: Andersen Laboratories' 2016 annual report includes the

Q39: The following pension information was disclosed by

Q40: The income tax footnote to the financial

Q41: The following is an excerpt from Regina

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents