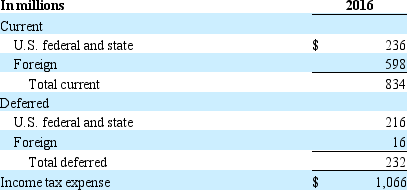

The income tax footnote to the financial statements of Cucumber, Inc. for the year ending December 31, 2016 is as follows.

A. How much income tax expense is reported in Cucumber, Inc.'s income statement for 2016?

A. How much income tax expense is reported in Cucumber, Inc.'s income statement for 2016?

B. How much of the income tax expense is payable in cash in 2016?

C. Provide an example to explain how the deferred tax expenses could be positive in 2016?

Correct Answer:

Verified

B. $834 million is pay...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: Monongahela Corporation includes the following in its

Q36: Pacific Northwest Sporting Goods reported annual depreciation

Q37: Sweets Corp. reported the following items in

Q38: Andersen Laboratories' 2016 annual report includes the

Q39: The following pension information was disclosed by

Q41: The following is an excerpt from Regina

Q42: The following pension information was disclosed by

Q43: The following is an excerpt from the

Q44: Festival Corp. disclosed the following lease information

Q45: The following is the leasing commitment information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents