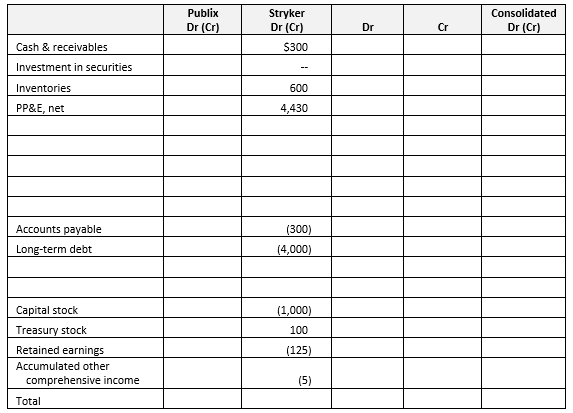

The balance sheets of Publix Corporation and Stryker Corporation, just prior to Publix' acquisition of all of Stryker's voting stock, are as follows:

An analysis of Stryker's assets and liabilities reveals that book values of some reported items do not reflect their fair values at the date of acquisition:

•Inventories are overvalued by $350

•Property, plant and equipment is overvalued by $2,200

•Long-term debt is undervalued by $200

In addition, the following items are not currently reported on Stryker's balance sheet:

•Favorable lease agreements, valued at $60

•Skilled work force, valued at $200

•Signed customer contracts for product development, valued at $50

•In-process research and development, valued at $175

•Favorable press reviews on Stryker's products, valued at $5

•There are lawsuits pending against Stryker, not currently recorded. The best estimate of likely losses on these lawsuits, at present value, is $6

Publix issued no-par capital stock with a market value of $2,400 for all the voting stock of Stryker. Registration fees in connection with issuing the stock are $50, paid in cash. Consulting, accounting, and legal fees connected with the merger are $80, paid in cash. In addition, Publix enters into an earnings contingency agreement, whereby Publix will pay the former shareholders of Stryker an additional amount if Stryker's performance meets certain minimum levels. The present value of the contingency is estimated at $90.

Required a. Prepare Publix's journal entry to record the acquisition of Stryker.

b. The consolidation working paper at the date of acquisition appears below. Fill in Publix's column and the elimination and consolidated balances columns as necessary to consolidate the balance sheet accounts of Publix with Stryker at the date of acquisition.

Correct Answer:

Verified

Q100: Dr. Pepper Snapple Group (DPSG) acquired

Q101: Packet Industries purchased all the voting

Q102: PLD Company purchased all the shares

Q103: Provo Company purchased all the shares

Q104: Pacifica Company acquires all the voting stock

Q105: Parkside Company issued stock to acquire

Q106: Pebble Company pays $60 million in

Q108: ADL Corporation issued 1,500,000 shares of

Q109: Pinoy Company acquired all the stock of

Q110: Serano Corporation's trial balance is as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents