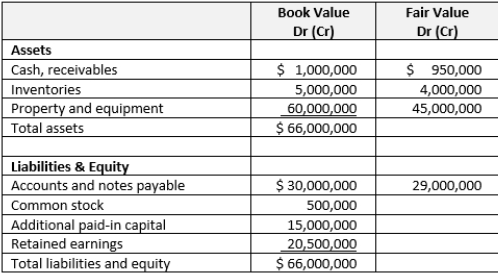

Bed & Bath buys all of Costless Company's assets and liabilities. Costless' balance sheet at the date of acquisition, including fair value information on its reported assets and liabilities, is as follows:

In addition, a deferred tax liability of $2,000,000 is recognized as part of the acquisition.

The acquisition terms are as follows:

•Bed & Bath paid Costless' shareholders a total of $25,000,000 in cash.

•Bed & Bath issued a total of 2,000,000 new shares of its common stock to Costless' shareholders. Bed & Bath's shares have a par value of $1/share and a total fair value of $92,000,000. Bed & Bath paid $900,000 in cash for registration fees to issue the shares.

•Bed & Bath paid $1,000,000 to Goldman Sachs for merger advisement, all paid in cash.

Required

Prepare the journal entry to record this acquisition on Bed & Bath's books.

Correct Answer:

Verified

\...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Delight Candy acquires all of the

Q106: Schenk Corporation's balance sheet immediately prior to

Q107: Plunk Corporation currently holds a 75 percent

Q108: Paxata Corporation holds a 35 percent interest

Q109: Peabody Company acquires all of the assets

Q110: PNC Corporation acquires all of the assets

Q111: Date-of-acquisition information on Fizzy Beverage's assets

Q112: Date-of-acquisition information on an acquired company's

Q113: Serano Corporation's trial balance is as

Q114: International Auto (IA) acquires Genuine Parts, Inc.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents