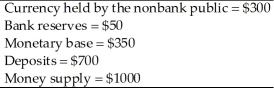

Consider an economy that has the following monetary data.

The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.What is the cost to the public of the inflation tax?

A) $60

B) $140

C) $190

D) $200

Correct Answer:

Verified

Q78: Which of the following policies would not

Q79: The relationship between the government deficit and

Q80: Suppose that real GDP is 10,000 and

Q81: Real money demand in the economy is

Q82: The real seignorage collected by the government

Q84: Assume that in an all-currency economy the

Q85: In an all-currency economy in which real

Q86: When the United States engaged in quantitative

Q87: How is real seignorage revenue related to

Q88: Consider an economy that has the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents