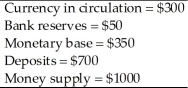

Consider an economy that has the following monetary data.

The monetary base and the money supply are expected to grow at a constant rate of 20% per year.Inflation and expected inflation are 20% per year.Suppose that bank reserves and currency pay no interest,all currency is held by the public,and bank deposits pay no interest.

(a)What is the cost to the public of the inflation tax?

(b)What is the nominal value of seignorage over the year?

(c)What is the profit to the banks from the inflation?

Correct Answer:

Verified

(b...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Consider an economy that has the following

Q84: Assume that in an all-currency economy the

Q85: In an all-currency economy in which real

Q86: When the United States engaged in quantitative

Q87: How is real seignorage revenue related to

Q89: Whether real seignorage revenue increases when the

Q90: Real money demand in the economy is

Q91: When the United States engaged in quantitative

Q92: When did the United States suffer hyperinflation?

A)Revolutionary

Q93: The inflation tax is primarily a tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents