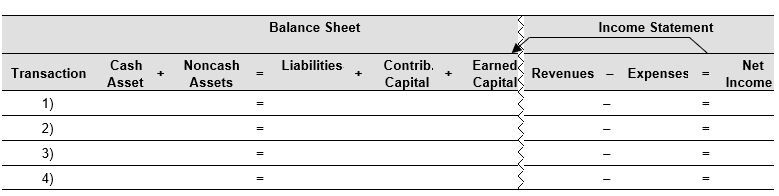

Record the following transactions of Beacon Inc. in the financial statements effects template below. Assume the transactions occur in 2018.

1) Purchased 2,800 shares of New City Corp. common stock for $40 per share. These securities are publicly traded and Beacon has no influence over New City's business decisions.

2) Received a cash dividend of $3.20 per share from New City.

3) Year-end market price of New City common stock is $30.40 per share.

4) Sold 1,200 shares for $25.60 per share, the closing price for the day.

Correct Answer:

Verified

Q40: Assume a company enters into a futures

Q41: Syracuse, Inc., reports the following details of

Q42: Syracuse, Inc. reported net income of $202,052

Q43: The 2017 annual report of Albany Corporation

Q44: In footnotes to its 2016 annual report,

Q46: Rapid City Corp. invests in the publicly

Q47: On January 1, 2017, Gillettey Company purchases

Q48: On January 1, 2017, Meadowlark, Inc. acquired

Q49: Thermopolis Industries acquired common stock of

Q50: Dubois Corporation purchases an investment in Teton,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents