Thermopolis Industries Acquired Common Stock of Riverton, Inc Purchase 4,000 (15%) of the Common Shares of Riverton, Inc

Thermopolis Industries acquired common stock of Riverton, Inc. as an investment. Consider the following transactions.

2018:

Purchase 4,000 (15%) of the common shares of Riverton, Inc. for $20.40 cash per share plus a $1,740 brokerage commission

Riverton reports net income of $118,200.

Thermopolis receives a cash dividend of $2.28 per share from Riverton, Inc.

Year-end market price of Riverton is $21.60 per share

2019:

Sell all 4,000 shares for $19.80 per share.

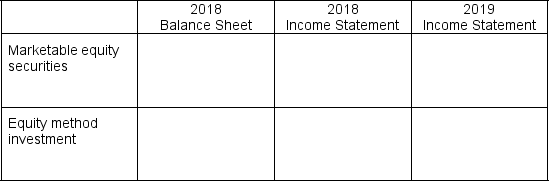

Complete the table below to show what Thermopolis Industries would report on its balance sheet in 2018 and on its income statement in 2018 and 2019 if the investment is classified as a passive investment in marketable equity securities, or as an equity method investment.

Correct Answer:

Verified

Q44: In footnotes to its 2016 annual report,

Q45: Record the following transactions of Beacon Inc.

Q46: Rapid City Corp. invests in the publicly

Q47: On January 1, 2017, Gillettey Company purchases

Q48: On January 1, 2017, Meadowlark, Inc. acquired

Q50: Dubois Corporation purchases an investment in Teton,

Q51: In 2013, West Yellow Corporation made a

Q52: Buttle Co. invests in the stock of

Q53: Consider companies with the pre-acquisition balance sheets

Q54: Missoula Company acquires 100% of the outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents