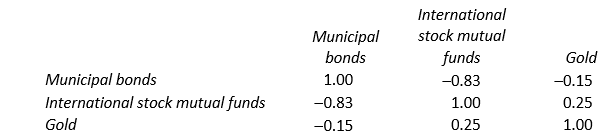

Using the given correlation matrix, which of the following statements is incorrect?

A) Gold and municipal bonds are perfectly, negatively correlated.

B) Gold and international stock mutual funds are positively correlated.

C) There is a negative correlation between the returns on international stock mutual funds and municipal bonds.

D) If one owned lots of municipal bonds, a good diversification strategy would be to purchase international stock mutual funds.

Correct Answer:

Verified

Q24: Which of the following statements is false?

A)

Q25: Following is a chart of the correlation

Q26: Following is a chart of the correlation

Q27: Stock returns are typically:

A) positively correlated with

Q28: Diversification is most effective when the returns

Q30: Using the given correlation matrix of these

Q31: Which of the following is the basis

Q32: What is the likely correlation between milk,

Q33: What is the likely correlation between gold

Q34: Suppose that you read that the stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents