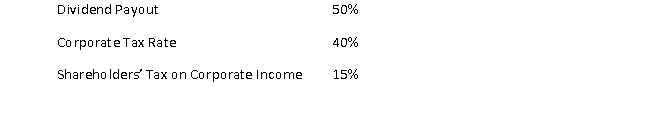

Calculate the effective tax rate on corporate income using the following information.

Correct Answer:

Verified

Q83: The more debt capital, relative to equity

Q84: The uncertainty associated with the use of

Q85: Describe what a limited liability company (LLC)

Q86: Compare a Sub Chapter S Corporation and

Q87: You are consulting with a start-up business.

Q89: Calculate the effective tax rate on corporate

Q90: Calculate the effective tax rate on corporate

Q91: Fill in the blanks. Considerations in evaluating

Q92: Calculate the effective tax rate on corporate

Q93: Who are the stakeholders of a university?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents