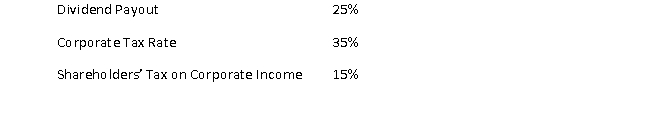

Calculate the effective tax rate on corporate income using the following information.

Correct Answer:

Verified

Q84: The uncertainty associated with the use of

Q85: Describe what a limited liability company (LLC)

Q86: Compare a Sub Chapter S Corporation and

Q87: You are consulting with a start-up business.

Q88: Calculate the effective tax rate on corporate

Q90: Calculate the effective tax rate on corporate

Q91: Fill in the blanks. Considerations in evaluating

Q92: Calculate the effective tax rate on corporate

Q93: Who are the stakeholders of a university?

Q94: Who are the stakeholders of a ski

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents