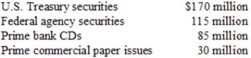

Stronghold Money Fund Assets is a relatively new money market fund with about $400 million in total financial assets and shares outstanding (each maintained at a value of $1.00 per share). Most of the fund's accounts represent the savings of high-income, interest-sensitive financial market investors. Stronghold's current distribution of financial assets currently is as follows:

Interest rates are expected to rise substantially in the money market over the next several weeks or months and Stronghold's management is concerned that its relatively low current yield (a seven-day average of 4.05 percent, one of the lowest yields among existing money funds) may result in the loss of many of its more interest-sensitive share accounts. The fund's average maturity is currently at 34 days, also substantially less than the industry's current average maturity of about 45 days. What steps would you recommend to help Stronghold Money Fund prepare for an apparent impending change in the money fund's condition?

Interest rates are expected to rise substantially in the money market over the next several weeks or months and Stronghold's management is concerned that its relatively low current yield (a seven-day average of 4.05 percent, one of the lowest yields among existing money funds) may result in the loss of many of its more interest-sensitive share accounts. The fund's average maturity is currently at 34 days, also substantially less than the industry's current average maturity of about 45 days. What steps would you recommend to help Stronghold Money Fund prepare for an apparent impending change in the money fund's condition?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: S&Ls are also referred to as:

A) Building

Q95: The early S&Ls were managed and directed

Q96: Total financial assets for S&Ls plus savings

Q97: In 2008 the global membership of credit

Q98: In 1970 the largest 20% of the

Q99: With 50,000 credit unions worldwide, they reside

Q100: Why has the savings and loan industry

Q101: What solutions have been developed to deal

Q102: What services do credit unions offer that

Q103: Axtell Credit Union elects to draw upon

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents