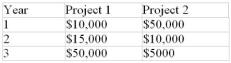

Two mutually exclusive projects each require an initial investment of $50,000 and should have a residual value of $10,000 after three years. The following table presents their forecast annual profits.

a) Calculate the IRR of each project. On the basis of their IRRs, which project should be selected?

a) Calculate the IRR of each project. On the basis of their IRRs, which project should be selected?

b) Which project should be selected if the firm's cost of capital is 14%?

c) Which project should be selected if the firm's cost of capital is 12%?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: The pro forma projections for growing a

Q50: Jasper Ski Corp. is studying the feasibility

Q51: Two mutually exclusive investments are available to

Q52: Academic Publishing is trying to decide which

Q53: Due to a restricted capital budget, a

Q55: A company is examining two mutually exclusive

Q56: A company is evaluating two mutually exclusive

Q57: The expected profits from a $52,000 investment

Q58: A firm is considering the purchase of

Q59: Projects X and Y both require an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents