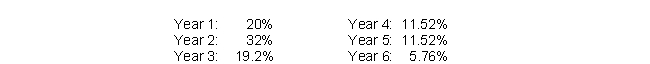

BonClyde Co. is planning to purchase an asset for $400,000. The asset is expected to return $50,000 per year for the next 7 years, with a disposal value of $15,000. BonClyde Co.'s required rate of return is 8%, and the applicable tax rate is 35%. The asset will be depreciated using the 5-Year MACRS rates, with a specific percentage of the original purchase value of the asset recognized as depreciation expense each year, as follows:

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

What is the NPV of the proposed asset purchase? Use a financial calculator to compute NPV.

Correct Answer:

Verified

Year 1: After-...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Atas Threads (AT) is a textile wholesale

Q18: Ikan Fishery, a local fish farm, is

Q19: Jensen Co. has additional funds available for

Q20: MRM Inc. has additional cash available for

Q21: What is meant by the term "capital

Q22: What is the cost of capital?

Q23: Arbitrary Inc. has is planning to purchase

Q24: Local Grown Inc., a local plant nursery,

Q25: GoodWash Co. is a dishwasher manufacturing company.

Q26: Batter Than Bacon, a local waffle shop,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents