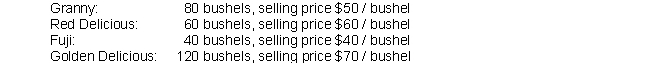

Harvest Growers, Inc. owns 4 types of apple orchards: Granny, Red Delicious, Fiji, and Golden Delicious. Some orchards are larger than others and therefore produce more apples, but proportions of total apple production tends to remain relatively constant. Harvest Growers recorded the following data from this month's sales:

Each bushel incurs the same variable costs, regardless of apple type. This month's total costs were $11,000. Total production last month was 250 bushels, and total costs were $10,000. The applicable tax rate is 25%.

Each bushel incurs the same variable costs, regardless of apple type. This month's total costs were $11,000. Total production last month was 250 bushels, and total costs were $10,000. The applicable tax rate is 25%.

If Harvest Growers desires that after-tax net income increase by 15% next month, how many bushels of Fuji apples does Harvest Growers need to sell? (Use the high-low method to calculate the cost equation. For intermediate and final calculations, round per-unit amounts to the nearest cent and the number of units up to the next whole unit).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: "Break-even" is the point at which total

Q4: Contribution margin ratio = Contribution Margin /

Q5: A company's "margin of safety" is the

Q6: Oches Company has analyzed its overhead costs

Q7: Chad Company charges a selling price of

Q8: Stewart Company charges a selling price of

Q9: What is the "break-even" point?

Q10: What is a company's margin of safety?

Q11: What is operating leverage, and how is

Q12: SwiftyShop is a gas station that sells

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents