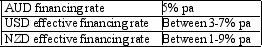

If the firm chooses NZ dollar financing then it is: An Australian firm is faced with the following financing alternatives:

A) risk averse.

B) risk neutral.

C) risk seeker.

D) Either risk neutral or a risk seeker.

Correct Answer:

Verified

Q9: An increase in the bid-offer spread in

Q10: A decrease in the bid-offer spread in

Q11: Domestic currency financing is more desirable to

Q12: Foreign currency financing is more desirable to

Q13: If the firm chooses Australian dollar financing

Q15: It is possible to lock in a

Q16: When an Australian firm borrows a foreign

Q17: When an Australian firm borrows a foreign

Q18: The effective financing rate is the foreign

Q19: A negative effective financing rate implies that:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents