The following information is to be used to answer the following questions

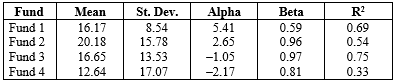

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The fund with the smallest proportion of systematic risk was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Correct Answer:

Verified

Q6: Superior portfolio performance can result:

A) from only

Q7: Select the correct statement about Sharpe's reward-to-variability

Q8: The following information is to be used

Q9: The following information is to be used

Q10: The following information is to be used

Q12: The following information is to be used

Q13: The following information is to be used

Q14: The last step in the investment process

Q15: Sharpe's reward-to-volatility ratio measures the excess return

Q16: Under Jensen's differential return approach to portfolio

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents