The following information is to be used to answer the following questions

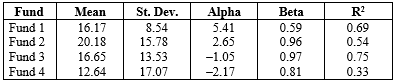

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The mutual fund with the lowest proportion of non-systematic risk was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Correct Answer:

Verified

Q7: Select the correct statement about Sharpe's reward-to-variability

Q8: The following information is to be used

Q9: The following information is to be used

Q10: The following information is to be used

Q11: The following information is to be used

Q13: The following information is to be used

Q14: The last step in the investment process

Q15: Sharpe's reward-to-volatility ratio measures the excess return

Q16: Under Jensen's differential return approach to portfolio

Q17: The dollar-weighted rate of return (DWR) measure:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents