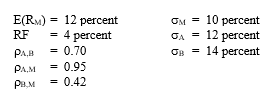

Given the following information:

(a) Calculate the betas for A and B.

(b) Determine the equation for the security market line.

(c) Calculate the required rates of return for the two stocks.

(d) Assume that an investor puts 70 percent in the market portfolio and 40 percent in the risk-free asset. What would the expected return and standard deviation of the portfolio be?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: At a given point the SML requires

Q52: A straight line has two mathematical necessities.

Q53: Suppose the SML has a risk-free rate

Q54: What does a security's beta measure in

Q55: In 1992, Fama and French published a

Q56: List two theoretical difficulties in testing the

Q57: The expected return for the market is

Q58: Given an expected return for the market

Q59: Given the following information: Q60: An analyst estimates that the expected returns

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents