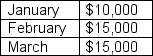

Mike is concerned about the cash receipts schedule of his business since all of the business's customers deal in credit instead of cash. Based on historical data, he is expecting to receive collections on accounts receivable (A/R) as follows: 55% in the month of sale, 40% in the next month after the sale, and 5% becomes uncollectible. Mike has decided to write off the business's uncollectible A/R at the end of second month after the sale. The following table provides the month-by-month summary of sales for Mike's business: Considering the above data, which of the following statements is correct?

Considering the above data, which of the following statements is correct?

A) In the month of April, uncollectible sales of $750 are taken as a direct write-off to A/R, and the budgeted ending balance of A/R on April 30 is $750.

B) In the month of February, uncollectible sales of $500 are taken as a direct write-off to A/R, and the budgeted ending balance of A/R on February 28 is $6,750.

C) In the month of January, uncollectible sales of $4,500 are taken as a direct write-off to A/R, and the budgeted ending balance of A/R on January 31 is $0.

D) In the month of March, uncollectible sales of $500 are taken as a direct write-off to A/R, and the budgeted ending balance of A/R on March 31 is $7,250.

Correct Answer:

Verified

Q92: The CFO of M Corp estimates the

Q93: What amount should Windshell Corp borrow to

Q94: Mallards Manufacturing produces tarps for camping, and

Q95: The Green Retail store is planning to

Q96: Brianna is trying to figure out the

Q98: Natalia is excited for her new start-up

Q99: Patricia handles the sales and marketing department

Q100: Keith, a manager of a store in

Q101: G mart deals in retail sales of

Q102: Olivia, the purchasing head of a small

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents