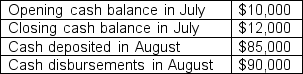

Natalia is excited for her new start-up and visits the bank to open a business checking account. Her relationship manager at the bank, Max, informs her about overall process and about the bank's requirement to maintain a minimum cash balance of $10,000 in her account at all times. Max also tells her about the easy access to lines of credit from the first day of the month, if the need for them arises. The annual interest on lines of credit is 10%, and it must be paid every month if there is an outstanding balance, but there is no need to make the principal payments each month. The following table provides additional information on this: If Natalia borrowed funds in increments of $100, then which of the following is correct for the month of August in the given scenario? (Round your calculations to the nearest whole number, if required.)

If Natalia borrowed funds in increments of $100, then which of the following is correct for the month of August in the given scenario? (Round your calculations to the nearest whole number, if required.)

A) Natalia can wait for next month's deposits; there is no need to borrow on a line of credit.

B) Natalia will borrow $3,000 to maintain the minimum cash balance, and her books will show the budgeted ending cash balance of $10,000.

C) Natalia will borrow $3,100 to maintain the minimum cash balance, and her books will show the budgeted ending cash balance of $10,074.

D) Natalia's books will show at least the sufficient amount of funds, and there will be no need to borrow.

Correct Answer:

Verified

Q93: What amount should Windshell Corp borrow to

Q94: Mallards Manufacturing produces tarps for camping, and

Q95: The Green Retail store is planning to

Q96: Brianna is trying to figure out the

Q97: Mike is concerned about the cash receipts

Q99: Patricia handles the sales and marketing department

Q100: Keith, a manager of a store in

Q101: G mart deals in retail sales of

Q102: Olivia, the purchasing head of a small

Q103: Teal's Supplies sells camping equipment to people

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents