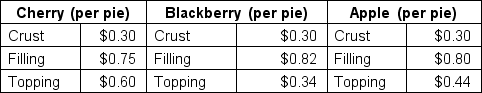

Sharon is a baker who owns a small bakery called Pie in the Sky that sells cherry pies. She has been debating adding new pies into her offerings, including blackberry and apple. Sharon is preparing a budgeted income statement for April so she can compare budgeted net income, when selling just cherry pies, to budgeted net income when selling other types of pies as well. She has decided that she will be able to sell the pies for the following prices: Cherry, $12; Blackberry, $10; and Apple, $13. Sharon will be able to produce 400 pies a month regardless of what kinds of pies she chooses to bake and sell. The pies have the following costs associated with them:

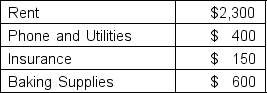

Sharon took out a $10,000 loan with an Annual Percentage Rate (APR) of 12% to begin her business, and she will have a flat tax rate of 21%. Her monthly fixed selling, general, and administrative (SG&A) expenses include the following:

Sharon took out a $10,000 loan with an Annual Percentage Rate (APR) of 12% to begin her business, and she will have a flat tax rate of 21%. Her monthly fixed selling, general, and administrative (SG&A) expenses include the following:

a. If Sharon decides to only sell cherry pies, then what will her budgeted sales revenue be for April?

a. If Sharon decides to only sell cherry pies, then what will her budgeted sales revenue be for April?

b. Assuming that Sharon proceeds with a), what would her gross margin and budgeted net income be for April?

c. If Sharon decides to sell 200 cherry pies and 100 each of both blackberry and apple, then what would her budgeted gross revenue be for April?

d. Assuming that Sharon proceeds with c), what would her budgeted gross margin and net income be for April?

e. Based upon what you have learned from choices b) and d), which approach would you encourage Sharon to utilize?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q131: Carlos is the production supervisor at West

Q132: Carolina Production sales embroidered baseball caps. The

Q133: The following information was provided to Jacob:

Q134: Ollie, LLC is an online business that

Q135: Knope, Inc. is an online retailer that

Q136: Kicks Shoes is an online store that

Q137: Rachel is a staff accountant at Bowl

Q138: Monarch, LLC is a graphic design business

Q139: Anna has recently started Dapper Doggies, a

Q140: Carolyn has been promoted to the position

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents