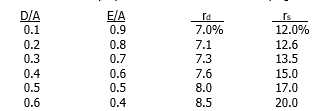

Ellison Enterprises has no debt, and is financed with 100 percent equity. The firm's marginal tax rate is 40 percent. However, Ellison's CFO is looking into restructuring the firm with some debt. He has estimated the costs of common equity and debt if Ellison raises varying amounts of capital.

If Ellison wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

If Ellison wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Do investors prefer dividends or capital gains?

Q21: What is the residual dividend model, and

Q22: Millar Corporation's value with no debt is

Q23: Timlin Motors' value with no debt is

Q24: Embree Inc.'s value with no debt is

Q25: Cabrera Construction has a capital budget of

Q26: Hattendorf Consulting has a current debt ratio

Q27: Boothe Co. expects EBIT of $3,000,000 for

Q28: Evanston Industries believes that at its current

Q29: The following information applies to Bright Techtronics:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents