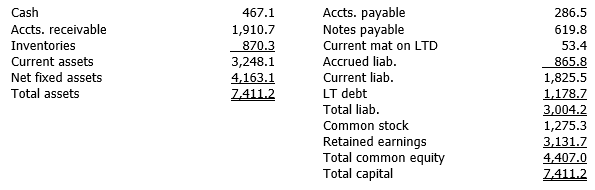

Gard Tennis Supply, a U.S. multinational, has a subsidiary in France with the following balance sheet (denominated in euros).

The spot exchange rate is $0.97380/euro. The company's CFO has estimated the following average exchange rates for inventories, fixed assets, common stock, and retained earnings: $0.96152, $0.9558, $1.1041, and $1.0853, respectively. The subsidiary is classified as a self-sustaining foreign entity. Translate the balance sheet into U.S. dollars, which is the reporting currency. (Hint: Depending upon the translation method used, all of the exchange rates may not be used.)

The spot exchange rate is $0.97380/euro. The company's CFO has estimated the following average exchange rates for inventories, fixed assets, common stock, and retained earnings: $0.96152, $0.9558, $1.1041, and $1.0853, respectively. The subsidiary is classified as a self-sustaining foreign entity. Translate the balance sheet into U.S. dollars, which is the reporting currency. (Hint: Depending upon the translation method used, all of the exchange rates may not be used.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: What is the difference between remeasuring and

Q16: Why is it important for financial managers

Q17: Differentiate between the current rate and temporal

Q18: How do the current rate and temporal

Q19: What unique characteristics does the cumulative translation

Q20: Differentiate between self-sustaining and integrated foreign subsidiaries,

Q21: If a subsidiary is in a country

Q22: How does a company develop a hedged

Q23: Generally speaking, accounting translation gains and losses

Q24: Witten Publishing, a U.S. multinational, has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents