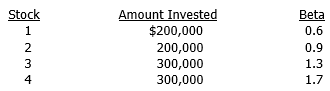

A money manager is holding the following portfolio:

The risk-free rate is 6 percent and the portfolio's required rate of return is 12 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

The risk-free rate is 6 percent and the portfolio's required rate of return is 12 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: What is risk aversion and how is

Q8: If stocks' returns do not appropriately compensate

Q9: What is the difference between stand-alone and

Q10: What is the difference between diversifiable and

Q11: What is the capital asset pricing model

Q12: When actually using the CAPM, what values

Q13: Brennan Beverages' stock has an estimated beta

Q14: A U.S. investor bought a one-year German

Q15: You are holding a stock that has

Q16: Assume that the risk-free rate is 5

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents