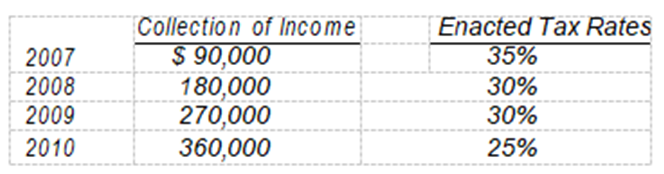

Karr, Inc. uses the accrual method of accounting for financial reporting purposes and appropriately uses the installment method of accounting for income tax purposes. Installment income of $900,000 will be collected in the following years when the enacted tax rates are:  The installment income is Karr's only temporary difference. What amount should be included in the deferred income tax liability in Karr's December 31, 2007 balance sheet?

The installment income is Karr's only temporary difference. What amount should be included in the deferred income tax liability in Karr's December 31, 2007 balance sheet?

A) $225,000

B) $256,500

C) $283,500

D) $315,000

Correct Answer:

Verified

Q59: Peck Co. reports a taxable and pretax

Q60: Bennington Corporation began operations in 2004. There

Q61: Ramos Corp.'s books showed pretax financial income

Q62: Eddy Corp.'s 2008 income statement showed pretax

Q63: On January 1, 2008, Lebo, Inc. purchased

Q64: On January 1, 2008, Magee Corp. purchased

Q65: Brock Corp.'s 2008 income statement had

Q66: In its 2007 income statement, Hertz Corp.

Q68: For calendar year 2007, Neer Corp. reported

Q69: Nevitt Co., organized on January 2, 2007,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents