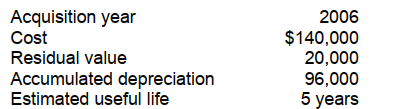

Mack Co. takes a full year's depreciation expense in the year of an asset's acquisition and no depreciation expense in the year of disposition. Data relating to one of Mack's depreciable assets at December 31, 2008 are as follows: Using the same depreciation method as used in 2006, 2007, and 2008, how much depreciation expense should Mack record in 2009 for this asset?

Using the same depreciation method as used in 2006, 2007, and 2008, how much depreciation expense should Mack record in 2009 for this asset?

A) $16,000

B) $24,000

C) $28,000

D) $32,000

Correct Answer:

Verified

Q54: Jeter Company purchased a new machine on

Q55: Rubber Soul Company reported the following data:

Q56: Wheeler Corporation constructed a building at a

Q57: On March 1, 2008, Dennis Company purchased

Q58: On March 1, 2008, Dennis Company purchased

Q59: During 2008, Aber Corporation constructed assets costing

Q60: Petty County owned an idle parcel of

Q62: Gray Football Co. had a player contract

Q63: Reed Co. exchanged nonmonetary assets with Wilton

Q64: A company is constructing an asset for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents