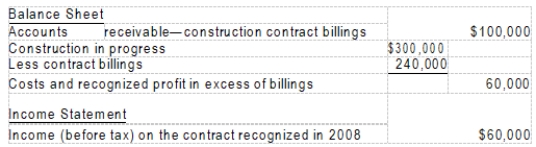

In 2008, Crane Corporation began construction work under a three-year contract. The contract price is $2,400,000. Crane uses the percentage-of- completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2008, follow:

-How much cash was collected in 2008 on this contract?

A) $100,000

B) $140,000

C) $20,000

D) $240,000

Correct Answer:

Verified

Q26: In accounting for long-term construction-type contracts, construction

Q27: Under the installment-sales method,

A) revenue, costs, and

Q28: The realization of income on installment sales

Q29: Reese Construction Corporation contracted to construct a

Q30: Winsor Construction Company uses the percentage-of-completion method

Q32: In 2008, Crane Corporation began construction work

Q33: Eaton Construction Co. uses the percentage-of-completion method.

Q34: Ramos, Inc. began work in 2008 on

Q35: Ramos, Inc. began work in 2008 on

Q36: Miley, Inc. began work in 2008 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents