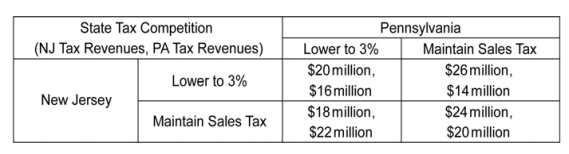

Contiguous states often use tax policy to attract residents, firms, and economic activity. These ʺtax competitionsʺ between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each stateʹs sales tax rate to 3 percent on each stateʹs sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

-Refer to the scenario above. Is there a set of payoffs that is superior to the payoffs realized at the dominant strategy equilibrium?

A) No.

B) Yes, New Jersey maintains its sales tax rate, realizing $18 million in tax revenues, and Pennsylvania lowers its sales tax rate, realizing $22 million in tax revenues.

C) Yes, New Jersey maintains its sales tax rate, realizing $24 million in tax revenues, and Pennsylvania also maintains its sales tax rate, realizing $20 million in tax revenues.

D) Yes, New Jersey lowers its sales tax rate, realizing $26 million in tax revenues, and Pennsylvania maintains its sales tax rate, realizing $14 million in tax revenues.

Correct Answer:

Verified

Q2: Consider another version of the advertising game

Q3: Vladimir and Alphonso are collectors of Toy

Q4: Another game frequently played in MBA strategy

Q5: Suppose two outdoor apparel firms, L.L. Bean

Q6: Bill and Tom are playing a game.

Q7: Two rival cosmetics brands are considering launching

Q8: Recall the trust game reported in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents