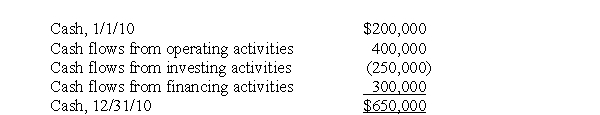

The following information is from Doubtfire Corporation's 2010 statement of cash flows.

During 2010, Doubtfire Corporation declared and paid its annual $20,000 of preferred stock dividends. On January 1, 2010, Doubtfire had 100,000 shares of common stock outstanding and 60,000 common shares were issued on April 1. Doubtfire had 20,000 shares of preferred stock outstanding on January 1 and issued no additional shares during 2010. Doubtfire must make $65,000 of principal and interest payments each year. All investing activities related to PP&E.

During 2010, Doubtfire Corporation declared and paid its annual $20,000 of preferred stock dividends. On January 1, 2010, Doubtfire had 100,000 shares of common stock outstanding and 60,000 common shares were issued on April 1. Doubtfire had 20,000 shares of preferred stock outstanding on January 1 and issued no additional shares during 2010. Doubtfire must make $65,000 of principal and interest payments each year. All investing activities related to PP&E.

Required:

a. What is Doubtfire's cash flow per share?

b. Use two methods to determine Doubtfire's free cash flow.

Correct Answer:

Verified

b. (1) Cash from operating activities -...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: A consistently negative trend in operating cash

Q76: Rather than using liquidity or solvency ratios,

Q77: U.S. companies often provide cash flow per

Q78: The "safe harbor" rule protects corporations against

Q79: Market valuations of companies are also often

Q80: The following information is from Hollywood Corporation's

Q81: The following information is from Cameron Corporation's

Q82: The following information is from Old Blue

Q83: During 2010, Maroon and Gold Corporation incurred

Q84: The following are Glad Corporation's 2009 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents