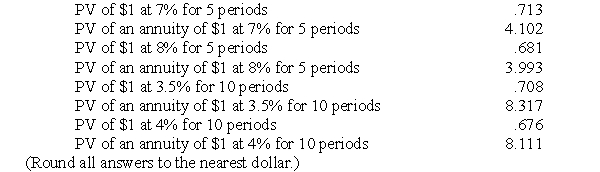

On January 1, 2010, Diego Corporation sold a $300,000, 8%, 5-year bond at a market rate of 7%. Interest is payable semiannually. The following present value factors may be necessary:

Required:

a. Prepare a journal entry for the issuance of the bond.

b. Regardless of your answer to (a), assume that the issue price of the bonds was $308,000. Prepare the first three interest expense entries for the bonds and the amortization of the discount using the effective interest method.

c. Using the information from (b), how would this bond be shown on a June 30, 2011, balance sheet?

Correct Answer:

Verified

Q109: To determine the present value of a

Q110: Under the effective interest method, interest expense

Q111: When a bond is sold at a

Q112: When a bond is sold at a

Q113: The following transactions were incurred by Showboat

Q114: The following events were incurred by Pulliam

Q115: The following events were incurred by Golden

Q116: The following transactions were incurred by Roundtop

Q117: Brenham Corporation's 2009 and 2010 balance sheets

Q118: On January 1, 2010, Carmen Corporation sold

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents