Pryce Corporation owns 8,000 of the 10,000 shares of outstanding common stock of Somber Company. On July 31, 2006, the end of a fiscal year, the stockholders' equity of Somber was $800,000, and the balance of Pryce's Investment in Somber Company Common Stock ledger account was $678,000, of which $38,000 was attributable to unimpaired goodwill. The current fair values of Somber's identifiable net assets had equaled their carrying amounts on the date of the Pryce-Somber business combination.

On August 1, 2006, Somber issued 2,000 shares of common stock to the public at $110 a share, net of out-of-pocket costs of issuing the stock. Both Pryce and Somber's minority stockholders waived their preemptive right.

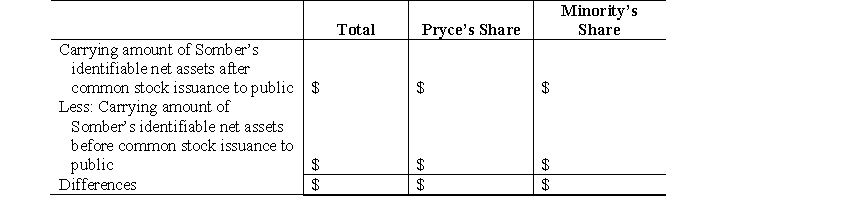

Prepare a working paper to compute the nonoperating gain or loss to Pryce Corporation resulting from Somber Company's issuance of common stock to the public. Use the following format:

Correct Answer:

Verified

Q19: A subsidiary's acquisition of its common stock

Q20: The minority interest of a subsidiary's preferred

Q21: On October 31, 2006, Palomar Corporation prepared

Q22: In working paper eliminations for a parent

Q23: A parent company's disposal of a portion

Q24: The stockholders' equity of Sidding Company on

Q26: The first working paper elimination (in journal

Q27: Separate and consolidated financial statements of Park

Q28: The stockholders' equity of Sprague Company on

Q29: If a partially owned subsidiary issues additional

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents