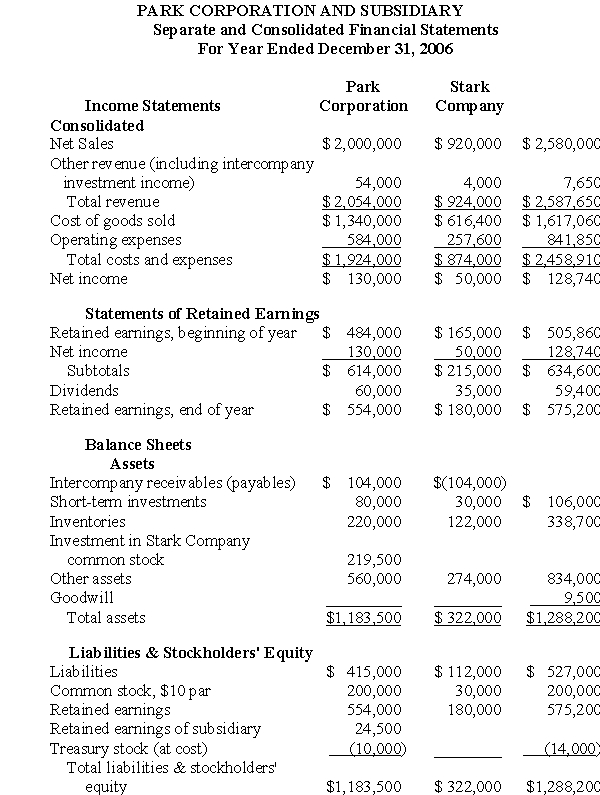

Separate and consolidated financial statements of Park Corporation and its subsidiary, Stark Company, for the fiscal year ended December 31, 2006, are shown below. Park used the equity method of accounting for its investment in Stark, but neither enterprise used separate ledger accounts for intercompany revenue, expenses, gains, or losses.

Additional Information :

Additional Information :

1. All of Stark's identifiable net assets were fairly stated at their carrying amounts on the date Park combined with Stark. The $10,000 excess of Park's investment in Stark over the current fair values (and carrying amounts) of Stark's identifiable net assets was allocated to goodwill, which was unimpaired on December 31, 2006.

2. Park sold merchandise to Stark at the same markup that Park realized on sales to its other customers.

3. Stark had acquired shares of Park's outstanding common stock on December 31, 2005. These shares were included in Stark's short-term investments.

4. Park acquired shares of its common stock for the treasury late in 2006 after the fourth-quarter dividend had been declared and paid.

From the foregoing information, provide answers for the following:

a. Percentage of Stark Company outstanding common stock owned by Park Corporation _______%

b. Intercompany sales by Park to Stark $________

c. Intercompany cost of goods sold eliminated $________

d. Intercompany investment income recognized by Park under the equity method of accounting $________

e. Amount of dividends received by Stark from Park and eliminated from other revenue $________

f. Amount of intercompany profit eliminated from ending inventories of Stark $_________

g. Number of shares of Park's common stock owned by Stark ________ shares

h. Carrying amount of Park common stock owned by Stark $________

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: A subsidiary's acquisition of its common stock

Q20: The minority interest of a subsidiary's preferred

Q21: On October 31, 2006, Palomar Corporation prepared

Q22: In working paper eliminations for a parent

Q23: A parent company's disposal of a portion

Q24: The stockholders' equity of Sidding Company on

Q25: Pryce Corporation owns 8,000 of the 10,000

Q26: The first working paper elimination (in journal

Q28: The stockholders' equity of Sprague Company on

Q29: If a partially owned subsidiary issues additional

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents