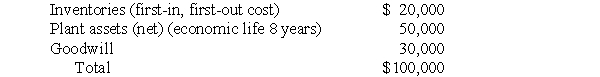

On July 1, 2005, Parson Corporation acquired all the outstanding common stock of Scate Company for $900,000. On that date, the carrying amount of Scate's identifiable net assets was $800,000. The difference of $100,000 was allocated as follows:

Scate had a net income of $190,000 and declared dividends of $100,000 for the fiscal year ended June 30, 2006. Scate uses straight-line depreciation for plant assets. Goodwill was one-thirtieth impaired on June 30, 2006.

Scate had a net income of $190,000 and declared dividends of $100,000 for the fiscal year ended June 30, 2006. Scate uses straight-line depreciation for plant assets. Goodwill was one-thirtieth impaired on June 30, 2006.

Prepare a working paper to compute the following for Parson Corporation under the equity method of accounting (disregard income taxes):

a. Balance of Intercompany Investment Income ledger account on June 30, 2006

b. Balance of Investment in Scate Company Common Stock ledger account on June 30, 2006

Correct Answer:

Verified

Q27: Under the equity method of accounting, dividends

Q28: Plover Corporation accounts for its 80%-owned purchased

Q29: The minority interest in net assets of

Q30: If a wholly owned subsidiary's net income

Q31: The Investment in Sark Company Common Stock

Q33: Selected ledger account balances (before closing entries)

Q34: For the fiscal year ended March 31,

Q35: Refer to the above facts. Assume that,

Q36: On the date of the business combination

Q37: On September 30, 2005, Phoenix Corporation paid

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents