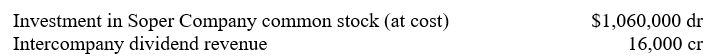

Selected ledger account balances (before closing entries) of Pome Corporation on September 30, 2006, one year after the business combination with an 80%-owned subsidiary, were as follows:

The carrying amount of Soper's identifiable net assets on September 30, 2005, was $1,200,000, which was the same as their current fair value on that date. Soper had a net income of $80,000 and declared and paid dividends of $20,000 during the fiscal year ended September 30, 2006. Goodwill was unimpaired on September 30, 2006.

The carrying amount of Soper's identifiable net assets on September 30, 2005, was $1,200,000, which was the same as their current fair value on that date. Soper had a net income of $80,000 and declared and paid dividends of $20,000 during the fiscal year ended September 30, 2006. Goodwill was unimpaired on September 30, 2006.

Prepare an adjusting entry on September 30, 2006, to convert Pome Corporation's accounting for the operations of Soper Company to the equity method of accounting from the cost method of accounting. Disregard income taxes.

Correct Answer:

Verified

Q28: Plover Corporation accounts for its 80%-owned purchased

Q29: The minority interest in net assets of

Q30: If a wholly owned subsidiary's net income

Q31: The Investment in Sark Company Common Stock

Q32: On July 1, 2005, Parson Corporation acquired

Q34: For the fiscal year ended March 31,

Q35: Refer to the above facts. Assume that,

Q36: On the date of the business combination

Q37: On September 30, 2005, Phoenix Corporation paid

Q38: The working paper elimination (in journal entry

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents