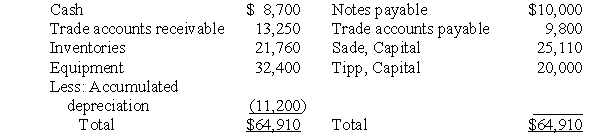

The balance sheet of Sade & Tipp LLP on April 30, 2006, was as follows:

The partnership was converted to S & T Corporation, with new accounting records. Sade and Tipp received a total of 10,000 shares of $1 par common stock in exchange for the net assets of the partnership. The accounting records of the partnership had been maintained in accordance with generally accepted accounting principles, except that an allowance for doubtful accounts of $800 had not been provided. The current fair values of the inventories and equipment were $28,000 and $35,000, respectively. Sade and Tipp shared net income and losses in a 3:2 ratio, respectively.

The partnership was converted to S & T Corporation, with new accounting records. Sade and Tipp received a total of 10,000 shares of $1 par common stock in exchange for the net assets of the partnership. The accounting records of the partnership had been maintained in accordance with generally accepted accounting principles, except that an allowance for doubtful accounts of $800 had not been provided. The current fair values of the inventories and equipment were $28,000 and $35,000, respectively. Sade and Tipp shared net income and losses in a 3:2 ratio, respectively.

Prepare journal entries for S & T Corporation on April 30, 2006, to record the transfer of net assets from the partnership and the issuance of common stock to the partners.

Correct Answer:

Verified

Q30: The partners of Jensen, Smith & Hart

Q31: The balance sheet of Ames, Beard &

Q32: After realization of a portion of the

Q33: The balance sheet of Quanto, Rollo &

Q34: The partners of Dunn, Carson & Devlin

Q35: The partners of Hendry & Kim LLP

Q37: The liabilities and partners' capital section of

Q38: The partners of Arthur, Baker & Casey

Q39: On March 1, 2005, both Anson Company

Q40: In a classroom discussion of accounting standards

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents