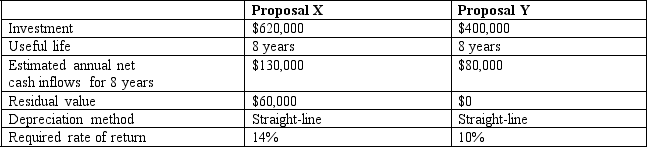

Simms Manufacturing is considering two alternative investment proposals with the following data: Note: Present value and future value tables are needed.

Note: Present value and future value tables are needed.

Using the net present value model, which alternative should Simms select, and why?

A) Proposal Y, because its net present value is $22,670 higher than the net present value of Proposal X.

B) Proposal Y, because it is the only alternative with a positive net present value.

C) Proposal X, because it is the only alternative with a positive net present value.

D) Both proposals are equivalent when using the net present value model.

Correct Answer:

Verified

Q1: Simms Manufacturing is considering two alternative investment

Q2: Logan, Inc. is evaluating two possible investments

Q3: Logan, Inc. is evaluating two possible investments

Q4: Simms Manufacturing is considering two alternative investment

Q6: Atlantic Company is considering investing in specialized

Q7: Logan, Inc. is evaluating two possible investments

Q8: Logan, Inc. is evaluating two possible investments

Q9: Head, Inc. is deciding whether to automate

Q10: The Petty Company has analyzed an investment

Q11: Jackson Corporation is considering the following three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents