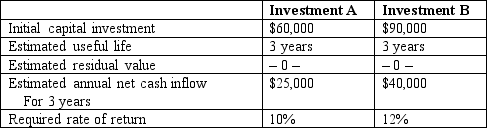

Logan, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available: The present value factors of $1 due 3 years from now are:

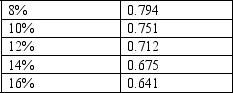

The present value factors of $1 due 3 years from now are: The annuity present value factors of $1 per year due at the end of each of 3 years are:

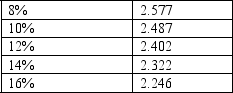

The annuity present value factors of $1 per year due at the end of each of 3 years are:

-The internal rate of return for Investment A is approximately what percentage?

A) 8%

B) 10%

C) 12%

D) 14%

Correct Answer:

Verified

Q1: Simms Manufacturing is considering two alternative investment

Q2: Logan, Inc. is evaluating two possible investments

Q3: Logan, Inc. is evaluating two possible investments

Q4: Simms Manufacturing is considering two alternative investment

Q5: Simms Manufacturing is considering two alternative investment

Q6: Atlantic Company is considering investing in specialized

Q8: Logan, Inc. is evaluating two possible investments

Q9: Head, Inc. is deciding whether to automate

Q10: The Petty Company has analyzed an investment

Q11: Jackson Corporation is considering the following three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents