Charmed Enterprises, a chocolate distribution company, prepares its master budget on a monthly and quarterly basis.

For the months of January, February and March, you are to compute the:

(a) Schedule of expected cash collections

(b) Inventory purchase budget and Cash Disbursements

(c) Cash budget

(1) Actual Sales in December were $60,000

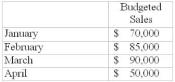

(2) Budgeted Sales for January, February, March and April are

(3) Sales are collected at a rate of 30% for cash, and 70% on credit. All payments on credit sales are collected in the month following the sale. $42,000 is the balance in accounts receivable at December 31, 2005. The beginning cash balance is $10,000 with no loans outstanding.

(4) Beginning inventory at January 1, 2006 is $12,600

(5) The companies gross profit rate is 40%

(6) Monthly expenses are budgeted as follows:

(a) Shipping is 5% of sales

(b) Depreciation $2,000 per month ( c) Other expenses 6% of sales

(d) Salaries and Wages are fixed at $9,000 per month

(e) Advertising is $4,500

(7) In January, the company expects to purchase equipment of $11,000 and in February they expect to purchase equipment of $3,000 and $4,000 in March $4,000

(8) At the end of each month, inventory on hand should equal 30% of the following month's sales needs, stated at cost.

(9) December cash purchases for inventory were $36,600 . We pay for inventory ½ in the current month and ½ in the month following (therefore we will pay $18,300 in January for December purchases).

(10) The company is required by its loan covenants to maintain a cash balance of $10,000. Further, it has an open line of credit with the bank. To reduce banking transaction cost, borrowing must be done at the beginning of a month and all repayments must be made at the end of a month. Finally, loans and repayments of principal must be in multiples of $1,000. Interest is paid only at the time of repayment of principal. The annual interest rate is 6%.

Correct Answer:

Verified

Q64: Pascal CO. has developed the following sales

Q65: The following information was pulled off the

Q66: Ledford Corporation has the following information available

Q67: Required:Prepare a schedule of cash disbursements for

Q68: The historical analysis of payment patterns of

Q70: What are some of the behavioral issues

Q71: The sales revenue budget is the starting

Q72: Briefly describe zero-base budgeting and contrast it

Q73: John, Stuart, Mills Company uses 10,000 units

Q74: Compare and contrast the EOQ model with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents