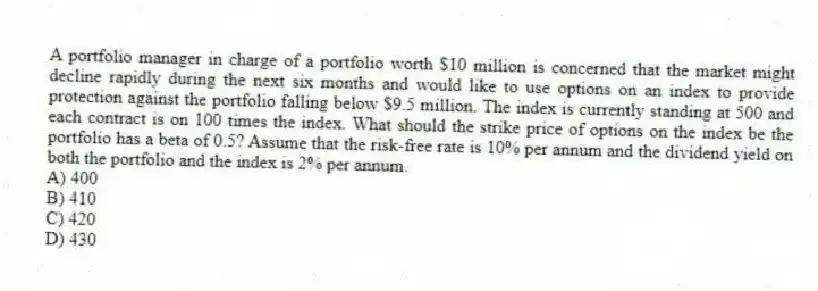

A portfolio manager in charge of a portfolio worth $10 million is concerned that the market might decline rapidly during the next six months and would like to use options on an index to provide protection against the portfolio falling below $9.5 million. The index is currently standing at 500 and each contract is on 100 times the index. What should the strike price of options on the index be the portfolio has a beta of 0.5? Assume that the risk-free rate is 10% per annum and the dividend yield on both the portfolio and the index is 2% per annum.

A) 400

B) 410

C) 420

D) 430

Correct Answer:

Verified

Q6: Suppose that the domestic risk free rate

Q7: A portfolio manager in charge of a

Q7: A binomial tree with one-month time steps

Q10: Index put options are used to provide

Q11: A portfolio manager in charge of a

Q13: Which of the following describes what a

Q14: For a European call option on a

Q15: Which of the following is true when

Q16: A European at-the-money call option on a

Q18: The domestic risk-free rate is 3%.The foreign

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents