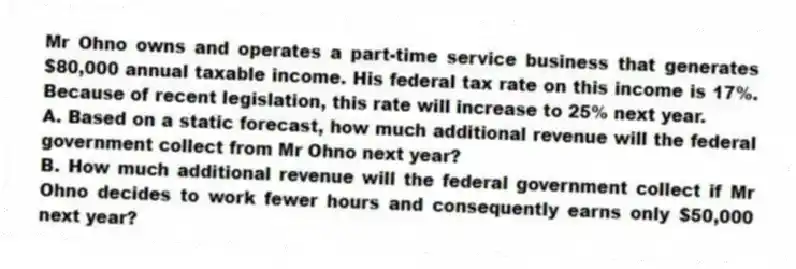

Mr Ohno owns and operates a part-time service business that generates $80,000 annual taxable income. His federal tax rate on this income is 17%. Because of recent legislation, this rate will increase to 25% next year.

A. Based on a static forecast, how much additional revenue will the federal government collect from Mr Ohno next year?

B. How much additional revenue will the federal government collect if Mr Ohno decides to work fewer hours and consequently earns only $50,000 next year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q75: Vervet County levies a real property

Q76: Vervet County levies a real property

Q77: Vervet County levies a real property

Q78: Jurisdiction M imposes an individual income

Q80: Assume that Congress plans to amend the

Q80: Assume that Congress plans to amend the

Q81: The country of Valhalla levies an income

Q82: Congress recently amended the tax law to

Q84: Mr.and Mrs.Boln earn $63,000 annual income and

Q85: The City of Willford levies a flat

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents